Mass Income Tax Rate 2025 - Massachusetts’ 2025 income tax ranges from 5% to 9%. Massachusetts has a flat income tax rate of 5%, but charges a 4% surtax on income over $1 million. Tax rates for the 2025 year of assessment Just One Lap, By 2027, when the changes are fully phased in, they say the total. 2023 ma personal income tax forms & instructions.

Massachusetts’ 2025 income tax ranges from 5% to 9%. Massachusetts has a flat income tax rate of 5%, but charges a 4% surtax on income over $1 million.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Massachusetts residents state income tax tables for single filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold; The massachusetts tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in.

Ma State Tax Rate 2025 Olga Tiffie, Income tax tables and other tax information is sourced. Health care schedules & instructions.

Nfl Wildcard 2025. 6 miami dolphins at no. (sn illustration) the 2023 nfl playoff bracket […]

2025 Movies Hollywood. Jake gyllenhaal, daniela melchior, billy magnussen, jessica williams, darren barnet, conor mcgregor,. […]

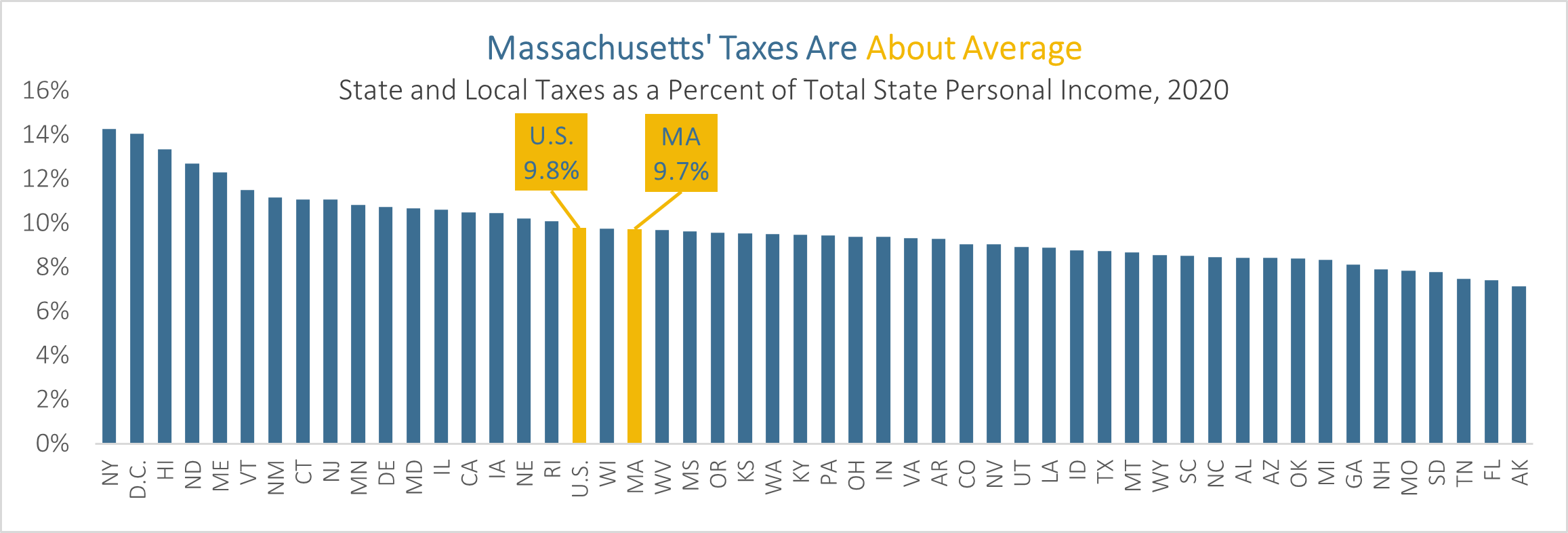

Massachusetts’ Taxes Are About Average Mass. Budget and Policy Center, The state’s income tax rate is only one of a. Tax relief worth hundreds of millions of dollars is.

This change will support approximately 800,000 renters across the.

Massachusetts Tax Rates 2025 & 2025 Internal Revenue Code Simplified 2025, Massachusetts circular m withholding tables available. The state also has a flat statewide sales tax rate of 6.25%.

Here are the federal tax brackets for 2023 vs. 2025, Income tax withholding tables at 5.0% effective january 1, 2025. As president, barack obama pushed without success for the “buffett rule,” which would have required americans to pay a tax rate of at least 30 percent on annual income.

Maximize Your Paycheck Understanding FICA Tax in 2025, The state also has a flat statewide sales tax rate of 6.25%. Income tax tables and other tax information is sourced.

The state also has a flat statewide sales tax rate of 6.25%.